MAXIMIZE RETAIL BANKING CUSTOMER ENGAGEMENT

Deliver customer-centric engagements to your banking customers in real-time with the most relevant content and channels

REDUCE COST PER ACQUISITION

INCREASE SHARE OF WALLET

BOOST CUSTOMER ACTIVATION

IMPROVE NPS AND CSAT SCORES

BOOST BANKING LOYALTY AND FINANCIAL PRODUCT REVENUE

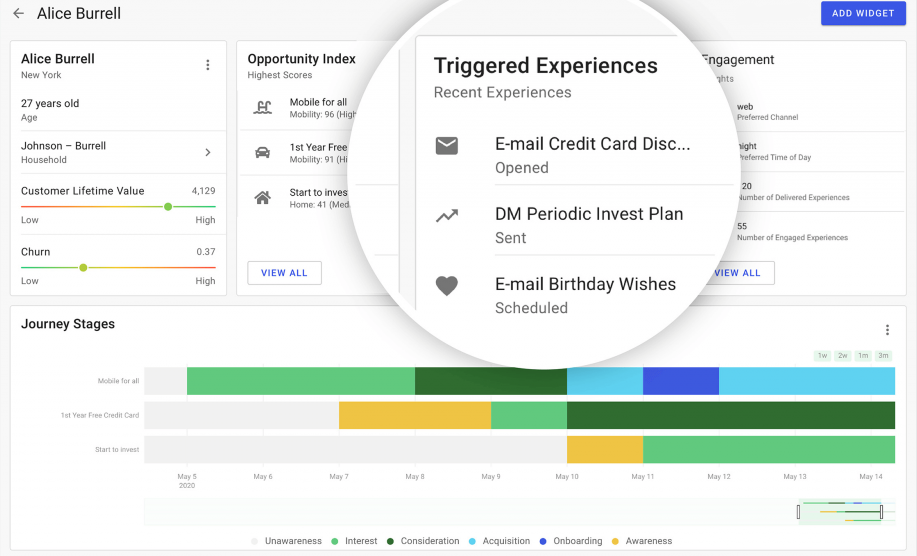

Unite your retail banking data into a full customer profile for a better customer experience

Segment Customers into AI-created audiences

Craft intelligent journeys for retail banking loyalty

GET PRE-BUILT playbooks for THE MOST common retail bank customer engagement needs

New mortgage awareness through onboarding

Credit card location targeting

Cash back reminders for new credit card

Loyalty reminders for VIP card holders

GO BEYOND THE BRANCH

In this NGDATA White Paper, you'll learn how to build data-driven, digital customer relationships.

PARTNER WITH NGDATA’S CUSTOMER SUCCESS TEAM TO TAILOR NGDATA TO YOUR RETAIL BANK CUSTOMER JOURNEYS

With over 10 years of experience implementing our Intelligent Engagement Platform for retail banks, we ensure your success with a strategic approach that spans four phases

UNDERSTAND YOUR NEEDS

Map your retail banking customer journey and intelligent engagement opportunities for your business goals

DESIGN YOUR SOLUTION

Outline a high-level functional design with data models, playbooks, and the most relevant offers and experiences

CUSTOMIZE YOUR PLATFORM

Leverage pre-built playbooks and custom solutions to build and configure your NGDATA instance for retail banking

VALIDATE AND DEPLOY

We activate your new Intelligent Engagement Platform with ongoing support, maintenance, and solution optimization

Connect with ngdata

Let's discuss your customer engagement needs and explore how you can harness the power of your data