Fewer Mortar and Bricks, More Digital Clicks

It’s an understatement to say it’s time for banks to digitize. Digital banking channels are preferred to all other banking channels globally. Although customers still value local branches and face-to-face conversations, the banks that can’t offer both are painting themselves into a corner.

Growing digital confidence has created a consumer base that expects seamless online banking experiences, from mobile apps to live chat features. Still, a range of other factors have also accelerated the trend. The COVID-19 pandemic was a key driver, but the democratization of transactional data has also welcomed a new wave of players to the financial services market. Now, our worldwide preference for digital is both a symptom of and a motivator for the banking sector’s rapid modernization.

The result? Customers don’t just want more. They can have more – and traditional banks need to evolve quickly and boldly to stay competitiv

The Transformation of a Traditional Sector

At the root of every bank’s need to modernize is a drive to satisfy their customers – but what do customers truly want, need, and expect? We asked more than 500 consumers about their attitudes towards banking and found that a bank’s reputation isn’t always enough to prevent them from switching providers.

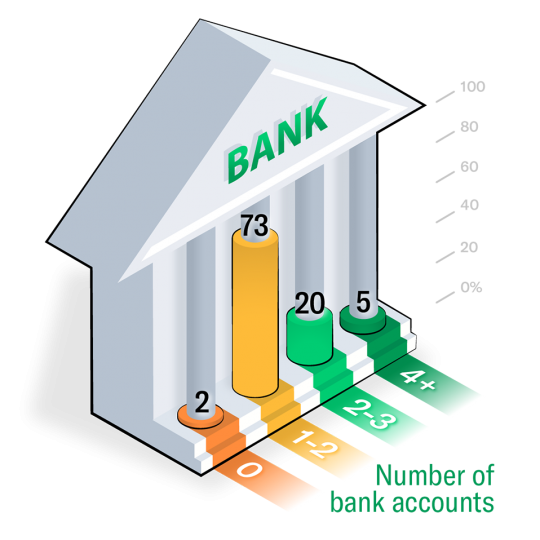

Consumers are comfortable ‘mixing and matching’ products and services nowadays, including developing relationships with multiple banking providers simultaneously. Our research found that 93% of consumers use 1-3 banks, with 5% using four or more.

As customers become more comfortable using online banking platforms, such as budgeting apps, we can expect digital-first enterprises to swoop in with convenience and ease as their unique selling points.

This is particularly likely amongst younger adult customers; Deloitte finding that credit cards from brands, not traditional lenders, are becoming increasingly popular amongst millennials. Furthermore, 15% of millennials’ banking interactions rely on alternative payment services like PayPal and Venmo. It’s clear that it’s not just the product or service that counts in banking but the customer’s experience of using it.

Millennials aren’t the only groups welcoming tech brands to the financial services market. 66% of our survey respondents (aged between 18-60+) would be most likely to trust technology companies with their banking services and associated data, followed by travel and hospitality, retail, and telecommunications.

Creating Tailored Transactions for Banking Customers

With the rise of open banking, it’s unlikely that the number of tech disruptors joining the financial sector will slow down. And, with so many organizations for customers to choose from, banks will need to focus on more than just products and services if they want to make the cut.

With the rise of open banking, it’s unlikely that the number of tech disruptors joining the financial sector will slow down. And, with so many organizations for customers to choose from, banks will need to focus on more than just products and services if they want to make the cut.

To drive real value for customers, banks will need to learn from tech brands to create meaningful connections, ensure contextually relevant engagements, and deliver always-on digital services (something that almost 70% of customers view as important or highly important from their banking providers).

Achieving true customer centricity is possible for traditional banks, which have a clear competitive advantage over new players – historical customer data. Banks can orchestrate relevant and rewarding journeys based on a deeper understanding of their customers by leveraging real-time historical and present-day insights.

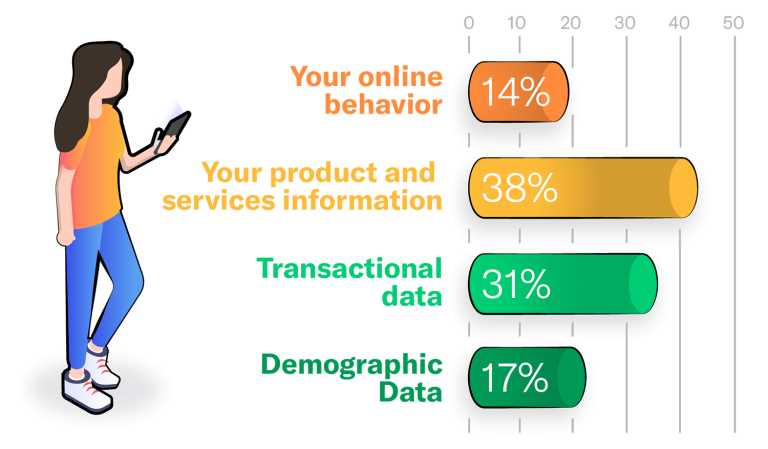

Our research shows that currently, customers are willing to share product and service information (38%) and transactional data (31%) before more personal insights, such as demographic data (17%) and online behavior (14%), in exchange for better banking experiences.

The challenge for banks is to demonstrate the value of data sharing by delivering personalized experiences in real-time, and for this, tech solutions are essential.

Exchanging Data for Great Experiences with the Intelligent Engagement Platform

At NGDATA, we know that unified data sets and real-time interaction management (RTIM) capabilities are vital for better customer experiences. Our advanced CDP, the Intelligent Engagement Platform, combines these functionalities to give marketers a holistic and always-optimized view of their customers and guide intelligent decision-making for more strategic marketing campaigns.

Our solutions are designed to help enterprises across all sectors, including the banking and financial services industry, deliver personalized and omnichannel experiences that foster loyalty, create advocacy, and ultimately maximize customer lifetime value (CLTV).

Get in touch to discover how our Intelligent Engagement Platform can help you create more meaningful banking experiences.